2025-2026 Budget Watch

The City’s budget process ensures that Loveland can provide exceptional service levels and allows for investment in infrastructure that will benefit our community for years to come. We take pride in effectively managing public funds, ensuring that every dollar is spent wisely and in the best interest of the community.

How the City Gets Its Revenue

The City receives funds from sources such as sales and use taxes, licenses and permits, charges for services, interest income and more.

- The General Fund supports services provided by the police, fire rescue, public works, library, parks and recreation, cultural services and more. Sales tax is the largest source of General Fund revenue.

- The City’s Enterprise Funds support services like water, wastewater, stormwater, power, solid waste and golf. Enterprise Funds are dedicated funds supported through user fees. Just like a business, user fees fund the operation, maintenance and capital projects necessary to provide the service. Only people who pay for these services receive the benefit of these services.

- Special Revenue Funds are dedicated funds established by federal or state law, or by municipal ordinance or resolution. Each has its own specific revenue source, such as the countywide Open Lands Sales Tax, which can only be used to support that specific service.

Of these three major fund types, both Enterprise and Special Revenue Funds are dedicated funds, which means they cannot be legally used for anything other than their dedicated purpose.

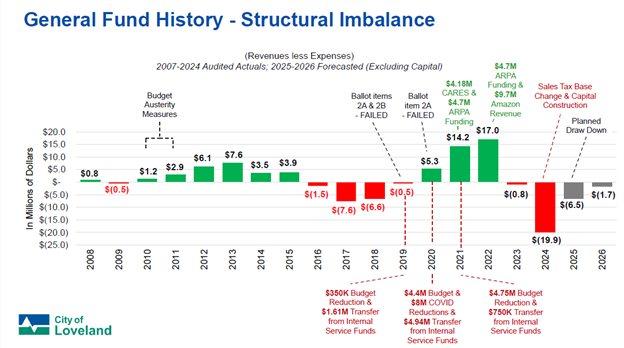

Changes in The City's General Fund Budget

Since 2016, the increases in costs to maintain infrastructure and provide services to the community have outpaced available revenue. In 2024, the City also lost an ongoing multi-million-dollar revenue stream to fund General Fund departments, including public safety (police and fire), transportation, community spaces (parks, library, museum, Rialto Theater, the Chilson Recreation and Senior Center and Winona Pool), infrastructure projects, general government services, and support services for nonprofits, small businesses, and residents in need.

Stay in the Know

Stay tuned to this webpage to learn more about the City’s 2025-2026 budget, ask questions and find helpful resources as the City prepares its 2026 Budget.

The budget and its process

Learn more about the team effort that is accurately forecasting the City's income and earmarking funds for projects, everyday expenses and more.

Types of funds

Learn more about the different types of funds at the City, including general and various enterprise funds.

Revenue and funding sources

Learn more about how the City operates and provides services through various funding sources.

Accountability and transparency

Learn more about our commitment to financial accountability and transparency.

The City’s budget process ensures that Loveland can provide exceptional service levels and allows for investment in infrastructure that will benefit our community for years to come. We take pride in effectively managing public funds, ensuring that every dollar is spent wisely and in the best interest of the community.

How the City Gets Its Revenue

The City receives funds from sources such as sales and use taxes, licenses and permits, charges for services, interest income and more.

- The General Fund supports services provided by the police, fire rescue, public works, library, parks and recreation, cultural services and more. Sales tax is the largest source of General Fund revenue.

- The City’s Enterprise Funds support services like water, wastewater, stormwater, power, solid waste and golf. Enterprise Funds are dedicated funds supported through user fees. Just like a business, user fees fund the operation, maintenance and capital projects necessary to provide the service. Only people who pay for these services receive the benefit of these services.

- Special Revenue Funds are dedicated funds established by federal or state law, or by municipal ordinance or resolution. Each has its own specific revenue source, such as the countywide Open Lands Sales Tax, which can only be used to support that specific service.

Of these three major fund types, both Enterprise and Special Revenue Funds are dedicated funds, which means they cannot be legally used for anything other than their dedicated purpose.

Changes in The City's General Fund Budget

Since 2016, the increases in costs to maintain infrastructure and provide services to the community have outpaced available revenue. In 2024, the City also lost an ongoing multi-million-dollar revenue stream to fund General Fund departments, including public safety (police and fire), transportation, community spaces (parks, library, museum, Rialto Theater, the Chilson Recreation and Senior Center and Winona Pool), infrastructure projects, general government services, and support services for nonprofits, small businesses, and residents in need.

Stay in the Know

Stay tuned to this webpage to learn more about the City’s 2025-2026 budget, ask questions and find helpful resources as the City prepares its 2026 Budget.

The budget and its process

Learn more about the team effort that is accurately forecasting the City's income and earmarking funds for projects, everyday expenses and more.

Types of funds

Learn more about the different types of funds at the City, including general and various enterprise funds.

Revenue and funding sources

Learn more about how the City operates and provides services through various funding sources.

Accountability and transparency

Learn more about our commitment to financial accountability and transparency.

-

December Funds in Focus event features parks and recreation funding

Share December Funds in Focus event features parks and recreation funding on Facebook Share December Funds in Focus event features parks and recreation funding on Twitter Share December Funds in Focus event features parks and recreation funding on Linkedin Email December Funds in Focus event features parks and recreation funding linkThe City of Loveland is hosting a Funds in Focus: Parks and Recreation public presentation on Wednesday, Dec. 17, 5:30 to 6:30 p.m. in City Council Chambers, 500 E. 3rd St. This is a hybrid event, with in-person and online attendance options, making it easy for community members to participate in the way that works best for them. Those who wish to attend online need to register at https://go.lovgov.org/park-rec-funds. Registered participants will receive a confirmation email with details on how to join the online meeting.

The event, which features Parks and Recreation Director Kara Kish, focuses on the funding sources that support the City of Loveland Parks and Recreation Department. These funding sources allow the city to offer quality of life services and programs, including parkland infrastructure and improvements, multi-modal trails, open lands, cemeteries, the Chilson Recreation and Senior Center, special events, golf courses, and more. Service level budget impacts and the strategies implemented by the department will also be discussed.

Attendees will have the opportunity to ask questions specific to parks and recreation.

“Our community has shown a lot of interest in the different facets of our municipal budget,” said Kish. “A deep dive into the Parks and Recreation budget will help our community connect the dots between the resources available and levels of service we are able to support.

To learn more about the City of Loveland Parks and Recreation department, visit lovgov.org/ParksRecreation.

-

City Council approves 2026 budget

Share City Council approves 2026 budget on Facebook Share City Council approves 2026 budget on Twitter Share City Council approves 2026 budget on Linkedin Email City Council approves 2026 budget linkThe City of Loveland 2026 budget was discussed by City Council at the annual budget workshop and adopted during a City Council public meeting on Tuesday, Oct. 21, 2025.

Leading up to final adoption, the budget was presented during three public meetings:

View the 2026 Approved Budget on the City of Loveland Finance Department's webpage.

-

City to host additional Funds in Focus event Sept. 25

Share City to host additional Funds in Focus event Sept. 25 on Facebook Share City to host additional Funds in Focus event Sept. 25 on Twitter Share City to host additional Funds in Focus event Sept. 25 on Linkedin Email City to host additional Funds in Focus event Sept. 25 linkThe City of Loveland invites residents to attend a second Funds in Focus hybrid event to learn more about the City’s budgeting process and the development of the 2026 budget. The event will take place on Thursday, Sept. 25, from 5:30 to 6:30 p.m. in the Rialto Theater’s Deveraux Room, located at 228 E. 4th St. This is a hybrid event, with an online attendance option, making it easy for community members to participate in the way that works best for them.

The session will revisit key information shared during the first Funds in Focus event held in July, although staff will introduce new content, including a summary of the Aug. 15 Budget Workshop. Attendees will also have the opportunity to ask questions and engage directly with the City’s Finance Department.

Residents who wish to attend online need to register for the event via Zoom. Registered participants will receive a confirmation email with details on how to join the online meeting.

Residents and business owners are encouraged to take part in various informative sessions hosted by the City of Loveland to better understand how public funds are allocated and how they can stay involved in the budgeting process. Similar events are being planned for October and November and both will feature an in-depth look into specific City of Loveland budget topics.

Stay informed

For additional information about the City of Loveland budget, visit lovgov.org/budget.

-

City of Loveland 2026 Budget Workshop Summary

Share City of Loveland 2026 Budget Workshop Summary on Facebook Share City of Loveland 2026 Budget Workshop Summary on Twitter Share City of Loveland 2026 Budget Workshop Summary on Linkedin Email City of Loveland 2026 Budget Workshop Summary linkThe City of Loveland held its 2026 Budget Workshop last month to review the City’s financial health and plans for the future. City Manager Jim Thompson highlighted progress over the last two years while noting that more work remains.

“I’m really happy that we are stable,” Thompson said. “But stability doesn’t mean we can provide every service our community wants. We have to take care of what we have first.”

Chief Financial Officer Brian Waldes explained that service-level changes made in 2024 stabilized the City’s General Fund, which pays for core services like police, fire, parks, public works, and other government and community services. No additional cuts are proposed for 2026, but funding challenges remain, especially for roads and infrastructure.

“Stable doesn’t mean solved,” Waldes said. “We’re borrowing from our future by shortening our capital improvement program to meet today’s needs.”

Key Takeaways from the Workshop

Financial Structure & Reserves

Loveland manages nearly 70 separate funds; most of which are stable, but the General Fund has been a challenge since 2016. To maintain the City’s bond rating and be prepared for emergencies, the City keeps a 15% contingency reserve.

The table below illustrates Loveland’s General Fund net income over the past 18 years. It highlights revenue challenges since 2016, and how the impacts of COVID budget cuts and one-time grant revenues impacted 2020-2022. With those cuts restored and COVID funding gone, the fund now faces the same pressures as in 2016–2019.

Revenue & Cost Pressures

Sales tax revenue, the City’s main source of funding for general services, has stayed mostly flat. CFO Waldes also announced that the City will start passing on credit card processing fees it has historically covered, aligning with common practices.

Roads & Infrastructure

The City maintains 396 miles of roads—about the distance from Loveland to Amarillo, TX. Road conditions are below the national average, and maintenance costs exceed available funds. Long-term funding solutions for roads and other infrastructure will need to remain a priority. The 2026 budget includes $4.5 million for the capital projects listed below to help address these needs.

2026 General Fund Capital Improvement Plan (CIP) Project Title Amount Percent (%) TRANS - Street Rehabilitation Program 2,604,198 57.9% TRANS - Garfield Bike Route 447,430 9.9% TRANS - US 287 and CO 402 Intersection 400,000 8.9% TRANS - Annual Bridge Maintenance 300,000 6.7% TRANS - Boyd Lake Ave/LCR 20E Roundabout 247,000 5.5% TRANS - Annual ITS & Communications 199,962 4.4% TRANS - US 34 Transit Sidewalk Connectivity 100,000 2.2% TRANS - Annual Transportation Planning 100,000 2.2% TRANS - HSIP Ped Crossing Improvements 51,410 1.1% TRANS - Annual Extended Projects 50,000 1.1% Total 2026 Capital Projects 4,500,000 100% Proposed 2026 General Fund Budget Highlights

The proposed 2026 budget includes targeted adjustments to maintain essential services and invest in high-need areas:

- $4.5 million in the General Fund dedicated to 2026 transportation projects.

- Four new Police Department positions (detective, lieutenant, patrol, and compliance) with modest operating increases.

- Parks & Recreation increases to support park operations, restroom hours, security, and July 4th programming.

- Support for the Foote Lagoon concert series and Loveland Museum exhibit marketing.

- Technology upgrades: a better functioning, accessible City website with a 311 citizen-reporting tool and public meetings software, revenue generating sales tax software and new time-tracking system.

- Expanded financial professional services.

- Employee recognition programs and compensation.

- Savings from General Fund due to reduced encampment costs following the closure of the South Railroad Facility.

- Smaller targeted increases across departments while keeping overall General Fund spending growth to 0.5%.

To see a summary of proposed 2026 General Fund Expenses by Department, check out slide 23 of the Budget Workshop presentation.

Utilities: Reliable Today, Resilient Tomorrow

Loveland Utilities operate 24/7 to provide power, water and wastewater services to about 40,000 homes and businesses. Utility funds are separate by law and cannot subsidize other City services. Proposed 2026 rates include a 4% increase for water and wastewater and a preliminary 5.8% electric increase (final pending a cost-of-service study). About $83 million in utility capital projects are planned to replace aging infrastructure and maintain reliable service.Pulse, the City’s broadband utility, is continuing to expand reliable, high-speed internet service while focusing on long-term financial sustainability. The 2026 budget includes funding to bring some contracted work in-house and invest in operations and customer support, helping Pulse maintain quality service and control costs.What's Next

City Council will review and vote on the proposed budget in October:

- First reading: October 7

- Second reading: October 21

Interested in learning more about the City’s budget? Attend the next Funds in Focus event, Thursday, Sept. 25, 5:30 to 6:30 p.m., at the Rialto Theater’s Devereaux Room, 228 E. 4th St. The session will revisit key information shared during the first Funds in Focus event held in July, although staff will introduce new content, including a summary of the Aug. 15 Budget Workshop. Attendees will also have the opportunity to ask questions and engage directly with the City’s Finance Department.

-

First look at proposed 2026 budget

Share First look at proposed 2026 budget on Facebook Share First look at proposed 2026 budget on Twitter Share First look at proposed 2026 budget on Linkedin Email First look at proposed 2026 budget linkOn August 14, The City’s finance team will hold its annual Budget Workshop with City Council, which also marks the first public discussion of the proposed 2026 City budget.

The public is welcome to attend this meeting, scheduled for 9 a.m., Thursday, Aug. 14, at the City’s Police and Courts Building, 810 E. 10th St.

In 2024, the City’s focus was on stabilizing the 2025 budget to align service levels with available revenue. While we’ve made progress and will not face reductions this year, our budget still falls short of fully meeting the needs of our organization and community. For 2026, we are emphasizing strategic financial planning as we work toward long-term sustainability.

Here are some key highlights ahead of the workshop:

Strategic Budgeting: The 2026 process involved a detailed, department-by-department review to ensure funding is aligned with operational needs, programs, and services.

Doing More with Less: We’ve made difficult reductions in several areas. The most notable was the encampment program, which had relied on temporary funds. With those funds exhausted, the decision was made to shift resources—freeing up ongoing general fund dollars for other priorities.

General Fund Increase: The proposed budget reflects a modest 0.5% increase in general fund spending from 2025 to 2026. While small, it allows for limited investments in growth-related needs, public safety, access to City services, and employee compensation, engagement and recognition.

Capital Improvement Projects (CIP): Maintaining City buildings and infrastructure is critical. The 2026 proposal includes $4.5 million for CIP, a number that remains well below our total identified needs. Still, we remain far from where we need to be.

Revenue Generation: The 2025 budget introduced several new or enhanced revenue sources to help offset service and operational costs. This best practice will continue moving forward.

Monitoring and Adjusting: We are closely tracking market and economic trends and will adjust our budget forecasts as needed before the end of the year.

Loveland remains a vibrant and valued community. Year after year, our community survey confirms how much residents appreciate City-provided services.

City leadership is committed to maintaining Loveland as a great place to work and live—and to securing a financially strong future for all.

Visit the Budget Workshop with City Council agenda and packet for more details.

-

Funds in Focus: City of Loveland thanks residents for attending, publishes questions and answers online

Share Funds in Focus: City of Loveland thanks residents for attending, publishes questions and answers online on Facebook Share Funds in Focus: City of Loveland thanks residents for attending, publishes questions and answers online on Twitter Share Funds in Focus: City of Loveland thanks residents for attending, publishes questions and answers online on Linkedin Email Funds in Focus: City of Loveland thanks residents for attending, publishes questions and answers online linkThe City of Loveland welcomed community members to its Funds in Focus budget information community event, on July 10, drawing strong participation both online and in person. A total of 167 people registered to attend virtually, with 79 joining live on Zoom. Another 29 attendees participated in person at Council Chambers.

The session gave residents an opportunity to learn about the City's budgeting process, priorities for 2026, and the factors that influence funding decisions. A highlight of the evening was a robust question-and-answer session where residents submitted questions about how city funds are allocated and managed.

City staff addressed many of these questions during the event and have since compiled all questions and responses into an online resource. Residents can view the results at https://www.letstalkloveland.org/29578/widgets/102467/documents/70696.

For those who missed the event, a recording and additional budget-related materials are also available at the same link.

“This event shows that our residents are highly engaged in our local government, and they want to know how services are funded and the considerations that go into building the annual budget,” said Chief Financial Officer Brian Waldes. “Thanks to everyone who gave us their evening to take an interest and ask questions.”

-

City of Loveland to host July 10 budget event

Share City of Loveland to host July 10 budget event on Facebook Share City of Loveland to host July 10 budget event on Twitter Share City of Loveland to host July 10 budget event on Linkedin Email City of Loveland to host July 10 budget event linkThe City of Loveland invites residents to participate in its upcoming Budget Funds in Focus event on Thursday, July 10, 2025, from 5:30 to 6:30 p.m. This hybrid event will offer both in-person and online attendance options, providing residents with an opportunity to learn more about the City’s budgeting process and the development of the 2026 budget. Attendees will also have an opportunity to ask questions and engage directly with City leaders and budget experts.

The Budget Funds in Focus event will be held in person at the Civic Center Municipal Building Council Chambers, 500 E. 3rd Street, and it will also be available online via Zoom. Online attendees can register for the live Zoom before noon, July 10, by visiting https://go.lovgov.org/2025FundsinFocus. Registrants for the online event will receive a confirmation email with information about joining the Zoom webinar.

“Last year’s Budget Information Session received overwhelmingly positive feedback from the community,” said Communication & Engagement Director Nicole Yost. “We hope that this event provides an extra level of transparency and the chance for our residents to understand how public funds are allocated and some of the nuances of various funds. We’re excited to offer this opportunity again and continue fostering meaningful civic opportunities to ask questions.”

Stay informed

To learn more about the City of Loveland’s budget, where City tax dollars are invested in the community, and more, visit our budget webpage.

Follow Project

Videos

-

Click here to play video

2025 Budget Funds in Focus: Parks and Recreation

The City of Loveland hosted Funds in Focus: Parks and Recreation on Wednesday, Dec. 17 with a goal of providing transparent information about the department budget, how decisions about budget are made, and to answer questions that the community has about the department budget and operations.

Click here to play video

2025 Budget Funds in Focus: Parks and Recreation

The City of Loveland hosted Funds in Focus: Parks and Recreation on Wednesday, Dec. 17 with a goal of providing transparent information about the department budget, how decisions about budget are made, and to answer questions that the community has about the department budget and operations.

-

Click here to play video

2025 Budget Funds in Focus Second Community Event

The City of Loveland goes through an extensive budget process each year to plan, outline, and manage expected income and expenses, and hosted its second public Funds in Focus event of the year on Sept. 25, 2025, offering residents a chance to learn and ask questions about the budget.

Click here to play video

2025 Budget Funds in Focus Second Community Event

The City of Loveland goes through an extensive budget process each year to plan, outline, and manage expected income and expenses, and hosted its second public Funds in Focus event of the year on Sept. 25, 2025, offering residents a chance to learn and ask questions about the budget.

-

Click here to play video

2025 Budget Funds in Focus Community Event

The City of Loveland goes through an extensive budget process each year to plan, outline, and manage expected income and expenses, and hosted its Funds in Focus event on July 10, 2025, offering residents a chance to learn and ask questions about the budget.

Click here to play video

2025 Budget Funds in Focus Community Event

The City of Loveland goes through an extensive budget process each year to plan, outline, and manage expected income and expenses, and hosted its Funds in Focus event on July 10, 2025, offering residents a chance to learn and ask questions about the budget.

Documents

-

Funds in Focus Parks and Recreation FAQ (119 KB) (pdf)

Funds in Focus Parks and Recreation FAQ (119 KB) (pdf)

-

2025 Budget Fund Types (8.65 MB) (pdf)

2025 Budget Fund Types (8.65 MB) (pdf)

-

2025 Making Cents of the General Fund (7.55 MB) (pdf)

2025 Making Cents of the General Fund (7.55 MB) (pdf)

-

2025 Sales Tax Comparison (649 KB) (pdf)

2025 Sales Tax Comparison (649 KB) (pdf)

-

2025 Local Property Tax Breakdown.pdf (119 KB) (pdf)

2025 Local Property Tax Breakdown.pdf (119 KB) (pdf)

-

2025 Regional Property Tax Comparison.pdf (8.32 MB) (pdf)

2025 Regional Property Tax Comparison.pdf (8.32 MB) (pdf)

-

2025 Tax Load Comparison.pdf (901 KB) (pdf)

2025 Tax Load Comparison.pdf (901 KB) (pdf)

-

Enterprise Funds Explained (1.01 MB) (pdf)

Enterprise Funds Explained (1.01 MB) (pdf)

-

July Funds in Focus Event Questions and Answers (147 KB) (pdf)

July Funds in Focus Event Questions and Answers (147 KB) (pdf)

2026 Budget Timeline

-

February - June 2025: Budget Review

2025-2026 Budget Watch has finished this stageDepartments review anticipated 2026 revenues and expenditures, and evaluate potential budgetary impacts due to economic conditions, legal and regulatory changes, and other impacts.

-

Aug. 2025: Budget Workshop

2025-2026 Budget Watch is currently at this stageThe City’s Finance Department hosts a public budget workshop to help staff and Council consider options for the draft 2026 budget. The City, with input from the community and City Council, prioritize community goals and find a reasonable balance between costs and services.

-

Sept./Oct. 2025: Council Work Session

this is an upcoming stage for 2025-2026 Budget WatchThis public meeting allows City Council to examine the 2026 budget proposal, seek clarifications, and provide feedback to staff.

-

Oct. / Nov. 2025: Budget Adoption

this is an upcoming stage for 2025-2026 Budget WatchPer City Charter, the budget is presented for consideration during regular Council meetings. The budget is adopted after two consecutive City Council approvals, referred to as “readings.”

-

Dec. 2025 - Jan. 2026: Budget Published

this is an upcoming stage for 2025-2026 Budget WatchAs the 2025 calendar year ends, the 2026 City budget is published on the City's website.

Who's Listening

-

-

-

-

-

KO